The war in Europe, resulted in a wave of sanctions and financial market instability.

As Vladimir Putin invaded Ukraine on his own, the rest of the world remained powerless, terrified of another disaster affecting their daily bread. Everyone throughout the world felt each Ukrainian tear in the recent week as millions were displaced from their homes, fears of inflationary trends, dwindling oil supplies, and stock market woes escalated worldwide. As Putin’s ruthless invasion grows into one of the world’s worst humanitarian disasters since World War II in Europe, the question remains whether the global economy can recover from the tremendous disruption caused by the world’s largest suppliers of basic goods like oil, food, and energy.

The Russian onslaught on Ukraine has led to a spate of sanctions and subsequent upheaval in global financial markets. The immediate casualty seems to be the energy space with the greatest impact on the distribution and the cost of oil. Reports also stated that the globe will not be able to bear another global recession so soon after the pandemic. Russia being one of the largest economies in terms of the GDP size and the ninth in terms of its population, any involvement in war will have a rippling effect on the world economy.

Energy Markets

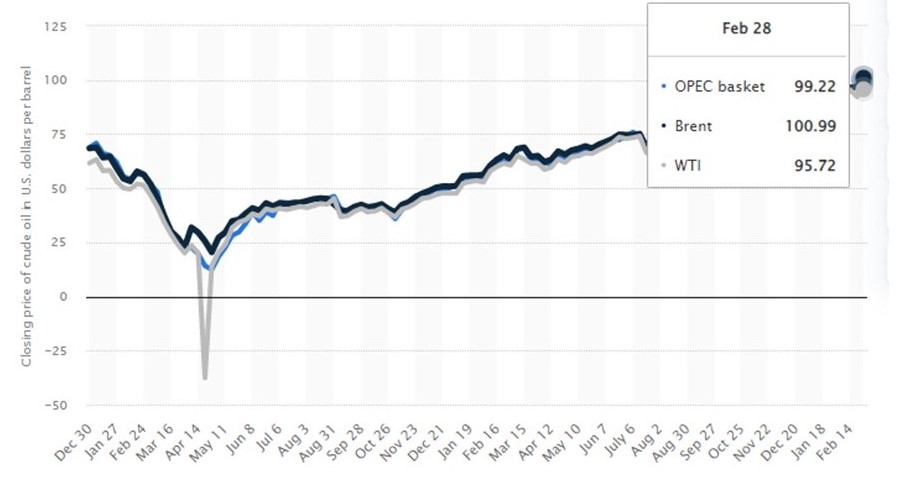

Given that Russia is the world’s second-largest petroleum producer, it supplies 35 percent of Europe’s natural gas and nearly half of Germany’s. Brent recently hit $105 a barrel, marking the beginning of a major supply disruption on oil markets that has been brewing since 2014, as crude prices have risen over $100. Markets have been apprehensive since the 2021 price spike, with the UK and Dutch gas prices fluctuating dramatically in the first week of the conflict, implying that the battle might not be ended just yet. It was also claimed that buyers of Russian oil were having difficulty obtaining guarantees from Western banks or satisfying the logistics requirements to transport crude. Inflation fears have been sparked by the rise in energy prices in Europe and around the world.

Inflation on the rise

Economic growth has certainly taken a hit across nations. Central banks are also strapped as they may have to go slower than earlier forecast with the rise in the interest rates a combative measure to tackle inflation. This may be due to the rush for inflation-linked bonds-securities that give a rise in payouts linked to inflation. The inflation-adjusted real yield-borrowing costs were lowered, while so-called breakeven, which indicate where markets expect future inflation to be, have risen sharply.

Data displayed in a several reports stated that that Germany was vulnerable to the surging European gas prices. The German 2-year breakevens rose by 3.7%.

Stock markets be wary of the bear

The global stock market suffered an almost $1 trillion loss, which might be attributed to nervous investors concerned about planned central bank rate hikes, but resulted in a sharp decline in the major indexes. While European STOXX market was hit by a 3.3 percent dip, the US markets fluctuated drastically giving speculation of an onslaught of bearish sentiment.

Last week, while Russian forces pillaged Ukrainian cities, the Russian stock market took a severe body blow, falling by a record 33 percent. The MSCI Russia Index dropped about 38 percent, making it one of the top three stock market crashes of all time. Ukraine, on the other hand, received a predictable punch and saw its government bonds plummet.

Praying for daily bread

While Germany has largely suspended its NordStream 2 activities, Ukraine has blocked supply from its ports, as has Russia, which has also halted cargo transit across the Artov Sea. Due to the strain on grain and oilseeds, markets experienced a spike in the price of basic wheat and grains, mirroring the global recessionary patterns of 2008. Despite the fact that the Black Sea region is open, even the tiniest disturbance could send food costs spiralling upwards as the region grapples with the pandemic’s aftermath.

What remains to be seen is how soon peace talks will take place to resolve the situation in Ukraine, to resuscitate global markets.