As the API economy evolves and matures, cashing in on them with effective monetization strategies is a sound business move that will help banks work with partners to reach new customer segments

Traditionally, banks built their products and devised services that customers paid to use. But over the last decade, there have been seismic changes within the sector, fuelled by the emergence of new technologies. The once stable sector must now contend with changing customer expectations and disruptive competition in the form of fintech firms and tech giants. And the business itself is becoming more customer centric while at the same time expanding the scope of financial services outside the four walls of the bank to tap into new revenue streams.

BaaS, partnerships with fintech firms and non-banking entities, banking platforms ecosystem, and open banking are some of the innovative new models that are changing the face of banking. And APIs or Application Programming Interface are at the core of this new wave of banking transformation, driving new operating models and strategies. And as banks continue their efforts to tap into new revenue sources, APIs present a significant monetisation opportunity. Banks must now prioritise monetisation strategies and engagement models with partners and third-party providers that are relevant to their organisation and APIs.

Understanding the API economy

APIs are widely in use across industries particularly when it comes to quoting, preparing estimates, and pricing. Sectors such as insurance, banking, retail, travel and hospitality, real estate, and software extensively utilize APIs. For example, when we book flight tickets via aggregator websites, APIs connect in the background to provide flight information.

As competition for customer share of wallet increases, traditional banks are now actively trying to engage with new partners and reach larger markets with innovative new business strategies. And in this, their biggest asset is the amount of customer data they hold within their vaults. Partners want this data, and the bank now can monetise this data through defined APIs and access sharing models. API monetisation is the process by which enterprises generate revenue from APIs. It’s an advanced tactic in API management, which can fuel digital transformation in the enterprise. API revenue represents the potential business income available to the organisation through APIs, which are packaged, promoted, and distributed as a digital service or offering.

Going back to the flight booking example, once the purchase decision is made, the payment gateway interacts with the bank’s APIs to facilitate the payment and communicate the payment details to the website for booking confirmation. APIs also come into play when one checks one’s credit score via a related website. The website in question will engage with all the banks that the user has accounts via their APIs to gather relevant information. It then consolidates the information and presents it to the user. Monetizing APIs simply means charging partners for accessing them. Banks can integrate and monetize APIs pertaining to functions such as liquidity overview, accounts payable and receivable, account reconciliation, invoicing, collections, approvals, travel expenses.

Currently, most banks are using APIs to connect internal systems, but over the next three years this is likely to change with maximum APIs connecting banking systems to platforms outside the organization. Awareness and interest in monetizing APIs is rising with more than 90 percent of organizations surveyed by McKinsey saying that they are already using or planning to leverage APIs to generate revenues from existing customers and three quarters stating that they intended to leverage APIs to generate income from new customers.2

The right technology for effective monetization strategies

APIs are deployed and managed by the bank. But in order to monetise them, they need a robust revenue management system that can effectively monetise APIs. Such a technology platform can easily devise multiple monetisation strategies that the bank can use with different partners and across different use cases.

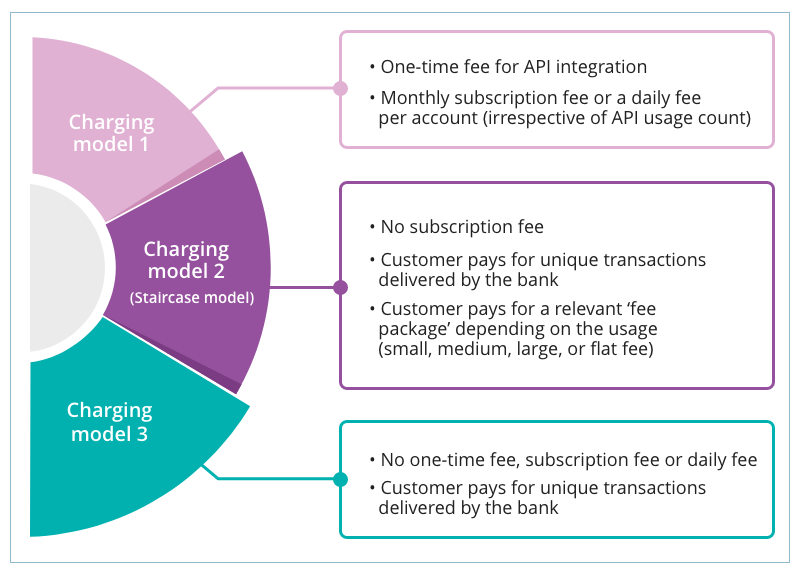

- Banks can charge a one-time fee for API integration/ attaching the file-module to the Business Online/District agreement. In addition to this they can charge a monthly subscription fee or a daily fee per account if there is a request to utilize the account information through the API. Under such a model it will be possible to ask for account information for the same account multiple times per day at the same cost.

- Another charging mechanism is where the customer pays for unique transactions delivered by the bank when the account information API is utilized. In this, there is no subscription fee, and the technology platform is equipped to analyse the customer’s actual usage of the API and places the customer in a relevant fee package accordingly (a staircase model). The fee package could be defined as small, medium, large, and flat fee. For example, a customer with limited usage is placed in a “small” package with the lowest prices. The customer pays directly for the benefits/ usage of API for each transaction.

- A third charging mechanism option is one in which the customer pays for unique transactions delivered by the bank when the account information API is utilized. There is no one-time fee, subscription fee or daily fee. This is similar to the above charging model, but customers are not segregated and charged as per the fee package.

Evidently, the revenue management system deployed is equipped with advanced data analytics capabilities. An AI-powered platform can analyse customer data quickly to suggest the best possible monetization strategies and manage the process end-to-end. An experienced partner can provide the robust, cloud-native, AI-powered platform that banks need to monetize their APIs.

Banking is proving to be a challenging business with changing customer expectations, increasing competition, evolving and stringent regulations, and unexpected macroeconomic disruptive events ranging from a pandemic to a war. Banks can no longer rely on traditional revenue generation methods and must consider innovative new approaches to maintain their profitability. As the API economy evolves and matures, cashing in on them with effective monetization strategies is a sound business move that will help banks work with partners to reach new customer segments. And it will help drive revenue growth for the organisation while simultaneously delivering a comprehensively integrated and customer centric experience that is vital for success in the modern banking world.

(This article is authored by Manoj M, Architect, SunTec Business Solutions)